Liquidation of branches of foreign undertakings—proposed amendments

Under proposed changes, the procedure for liquidation of branches of foreign undertakings would become easier and would also comply with EU law. Thus after several years of uncertainty and disagreement on this topic, Polish law should return to the position approved by the Supreme Court in 2007.

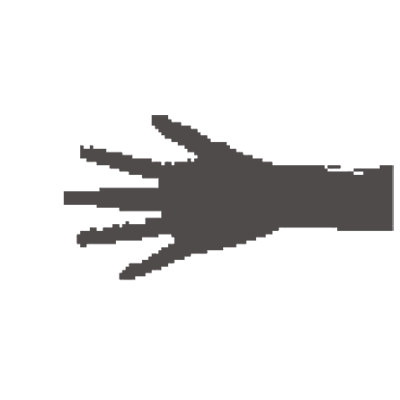

From 2018 income of management board members to be taxed at 18% and 32%

Under a proposed amendment to the Personal Income Tax Act, from 1 January 2018 the compensation of management board members will be taxed at regular rates (18%/32%), whether paid in cash or bonuses in the form of derivatives of financial instruments or other property rights.

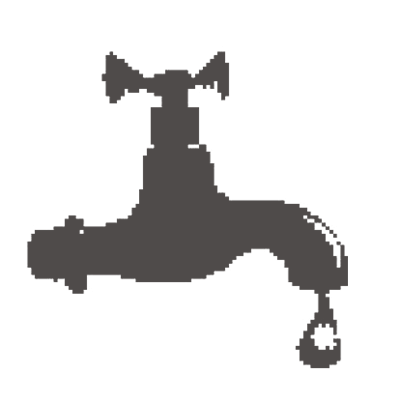

New Water Law—a revolution in water management

One of the most anticipated acts in the environmental arena has now been adopted: the new Water Law. This statute with 570 articles enters into force on 1 January 2018 and will fundamentally change the rules for water management in Poland.

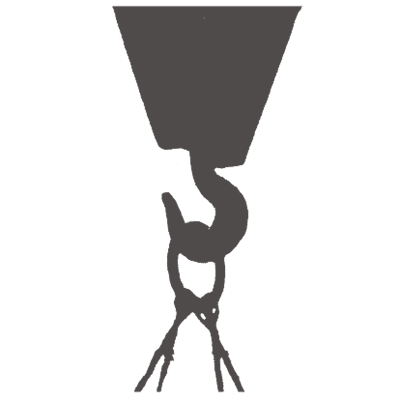

Restrictions on investor’s joint and several liability

The joint and several liability of the investor on a construction project for the fees of the subcontractors under Polish law is particularly strict. Thus owners of construction projects should note the statutory solutions (recourse claims by investors and limitations in subject matter and amount introduced in the amended Civil Code) and the permissible use of contractual clauses to soften this liability regime.

Mediation in administrative proceedings

Public administration is typically associated with authoritative decisions that can be modified only by challenging them through the administrative courts. A recently adopted amendment to the Administrative Procedure Code is designed to soften this image and make the state’s executive authority more citizen-friendly.

European administrative cooperation

Poland’s amended Administrative Procedure Code includes a new chapter governing the conduct of European administrative cooperation.

Change in rules for the investor’s joint and several liability in the construction process

A simplified procedure for notification of subcontractors, clarification of the rule on the investor’s objection to entrusting part of the work to a subcontractor, and limitation in the amount of the investor’s joint and several liability—all these changes are to go into effect on 1 June 2017.

Serious changes in Gambling Act

The latest amendment to the Gambling Act enters into force on 1 April 2017. The effective date may be a joke, but the changes are no laughing matter. Will they achieve the intended results?

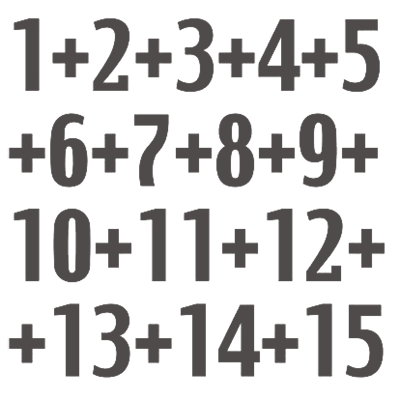

Tax sanctions imposed on cash transactions over PLN 15,000 from 1 January 2017

As of 2016, the limit for cash transactions is EUR 15,000, and there is no tax sanction for violating this limit. All of this will change from 1 January 2017.

Amendment of the Payment Services Act: Basic accounts and payment schemes

The amendment of the Payment Services Act is intended to implement the Payment Accounts Directive into the Polish legal system and to adapt Polish law to the Interchange Regulation. In addition to achieving compliance with EU regulations, the new provisions introduce a new type of regulated activity, as operators of payment schemes will be required to obtain approval from the head of the central bank.

The President has signed the new Concessions Act into law

The Act on Concession Contracts for Construction Works or Services of 21 October 2016 was signed by the President of Poland and published on 29 November. The act entered into force on 14 December.

New, lower corporate income tax—but not for everyone

A new tax rate for income of legal persons will enter into force on 1 January 2017. It will not apply to all taxpayers, however, but will depend on the amount of income. The same amending act introduces several other significant changes, particularly affecting the practice of corporate reorganisations (e.g. exchange of shares or in-kind contributions).